XRP Price Prediction: Technical Consolidation Meets Institutional Momentum

#XRP

- Technical indicators show consolidation above key support with weakening bearish momentum

- Institutional developments including ETF success and stablecoin launches provide strong fundamental support

- Supply shock potential from institutional accumulation could drive significant price appreciation

XRP Price Prediction

Technical Analysis: XRP Shows Bullish Consolidation Pattern

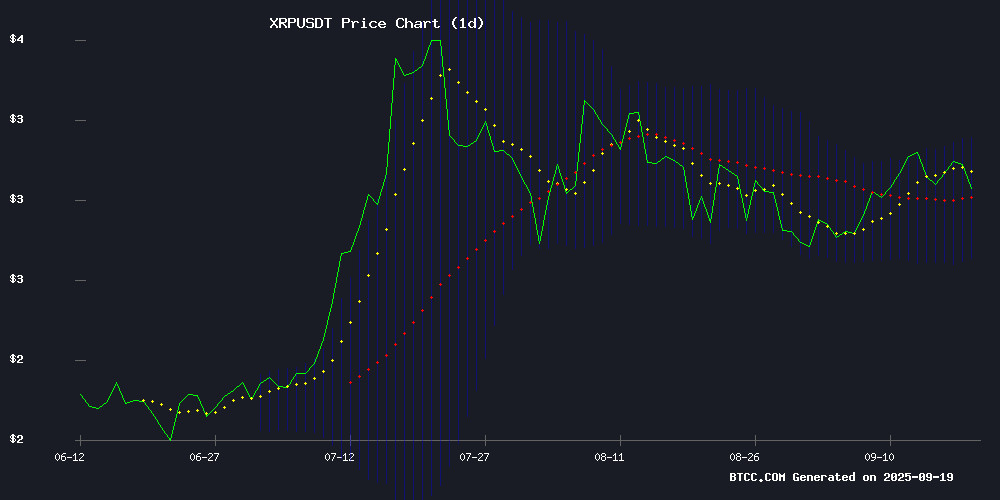

XRP is currently trading at $2.9919, slightly above its 20-day moving average of $2.9457, indicating underlying strength. The MACD reading of -0.1261 | -0.0570 | -0.0690 shows bearish momentum is weakening, while the Bollinger Bands configuration (Upper: $3.1764, Middle: $2.9457, Lower: $2.7150) suggests the asset is consolidating within a healthy range. According to BTCC financial analyst Olivia, 'The technical setup suggests XRP is building a solid foundation for potential upward movement, with the current price action indicating accumulation NEAR key support levels.'

Market Sentiment: Institutional Adoption Offsets Short-Term Volatility

Recent developments including the launch of XRP-backed stablecoins, SWIFT's ISO 20022 adoption, and record-breaking ETF performances are creating strong fundamental support. BTCC financial analyst Olivia notes, 'While short-term price action remains subdued, the institutional accumulation and ETF success stories signal growing mainstream acceptance. The $37M ETF debut volume and institutional accumulation patterns suggest potential supply shock dynamics that could drive prices significantly higher in the medium term.'

Factors Influencing XRP's Price

Enosys Launches XRP-Backed Stablecoin on Flare Network

Enosys has introduced 'Enosys Loans,' a pioneering initiative bringing the first XRP-backed stablecoin to the Flare network. This development marks a significant leap for decentralized finance, enabling XRP holders to mint overcollateralized stablecoins without liquidating their holdings.

The protocol initially supported FXRP and wFLR, now expanding to staked XRP (stXRP). Leveraging Collateralized Debt Positions (CDPs), Enosys aims to peg the stablecoin's value to $1 while preserving asset ownership. A stability pool mitigates liquidation risks, with users earning yield via mint fees and liquidation rewards.

Flare Time Series Oracle (FTSO) integration underscores the project's commitment to transparency and price stability. The MOVE unlocks new DeFi opportunities for XRP, long constrained by its utility token status.

SWIFT Embraces ISO 20022 Standard in Competitive Move Against Ripple's XRP

SWIFT, the global financial messaging network, has unveiled plans to adopt the ISO 20022 standard, signaling a strategic shift as it faces mounting competition from Ripple and its XRP-powered payment solutions. The announcement, highlighted by a SWIFT executive, emphasizes interoperability with diverse networks—including blockchain systems—without launching a proprietary token.

Ripple's reliance on the XRP Ledger and its native cryptocurrency contrasts sharply with SWIFT's approach. The legacy payments giant aims to leverage transaction orchestration and standardized data formats to integrate crypto networks through a unified framework. "This opens doors for banks to deliver value-added services," the SWIFT representative noted, sidestepping direct competition with XRP while modernizing infrastructure.

Analyst Dismisses $100 XRP Dream Amid Institutional Developments

Crypto Insight UK has tempered expectations for XRP's price surge, distinguishing between utility-driven growth and speculative hype. The analyst warns against unrealistic targets like $100, emphasizing disciplined profit-taking even if XRP reaches double digits. "I'll be taking 80% off the table," he stated, cautioning that euphoria often outpaces fundamentals.

Federal Reserve rate cuts and regulatory shifts—including the SEC's approval of spot commodity ETPs—provide macro tailwinds. Yet these developments remain secondary to crypto-specific drivers like flows and policy clarity. The market's reaction to Jerome Powell's dovish stance was muted, reinforcing the focus on micro-level catalysts.

XRP ETF Launch Breaks Records Amid Lackluster Price Action

The debut of the XRP-focused ETF (XRPP) shattered trading volume records, outpacing earlier XRP futures contracts by fivefold within 90 minutes. Institutional demand appears robust, yet the token’s spot price defied broader market gains, slipping 1% over 24 hours.

Derivatives data reveals growing bearish sentiment, with XRP’s long/short ratio hitting a 30-day low of 0.84. Traders are increasingly positioning for downside despite the ETF’s strong start—a divergence underscoring caution toward near-term upside potential.

XRP Targets $15 as ETF Buzz and Bullish Charts Align

XRP has formed a double bottom NEAR $3 and is now testing support after a strong breakout. The REX-Osprey XRP ETF, listed on Cboe under the ticker XRPR, debuted with $37.7 million in trading volume, marking the most active ETF launch of 2025. High-volume liquidity between $3–$3.05 bolsters the price, while resistance looms near $3.3–$3.5.

Technically, XRP trades near $3.05 with a weekly gain of just under 2%. A bull flag pattern on the weekly chart suggests a short-term target around $5.8, while a broader consolidation channel breakout since early 2024 points to a longer-term target of $15. RSI momentum sits below 60, indicating strength without overbought conditions.

Market analyst Zenia highlights structural developments, including new partnerships with DBS and Franklin Templeton, as key drivers. "The ETF debut and technical setup create a perfect storm for XRP," she noted, drawing parallels to past cycles.

First US XRP ETF Debuts with $24M Volume in 90 Minutes, Igniting Altcoin Rally Speculation

The REX-Osprey XRP ETF, the first US-based exchange-traded fund tied to XRP, launched with a staggering $24 million in trading volume within 90 minutes. The fund, structured through a Cayman Islands subsidiary, allows traditional investors to gain exposure to the third-largest cryptocurrency without direct custody challenges.

Bloomberg Senior ETF Analyst Eric Balchunas called the debut performance a 'semi-shock,' noting it outpaced XRP futures ETFs by fivefold on their first day. The strong institutional reception has fueled Optimism for broader crypto adoption, with 58% of Myriad users now predicting XRP will reach a new all-time high of $4.

As Uptober momentum builds, market participants are evaluating which altcoins might follow XRP's institutional tailwinds. The ETF's success underscores growing demand for regulated crypto investment vehicles while highlighting XRP's unique position as a bridge between traditional finance and blockchain-based payment solutions.

XRP Faces Price and Volume Decline Amid Market Shifts

Ripple's XRP slipped 1.16% to $3.04 on Friday, extending its retreat from the $3.07 level as trading volume contracted by nearly 13% to $6.06 billion. The simultaneous downturn in both metrics suggests waning trader interest, potentially foreshadowing a broader trend reversal for the digital asset.

While XRP managed a modest 0.52% weekly gain, its market capitalization held at $181.57 billion. The token's underperformance contrasts with notable gainers including Aster, Immutable and NEAR Protocol, while MYX Finance and MemeCore led decliners.

Market participants appear cautious amid evolving macroeconomic conditions and project-specific developments. The volume contraction particularly stands out, as liquidity serves as the lifeblood of cryptocurrency markets - when it ebbs, price stability often follows suit.

XRP Outperforms S&P 500 by 12x Over Five-Year Period

Ripple's XRP delivered staggering returns of 1,170% from September 2020 to September 2025, eclipsing the S&P 500's 101% gain during the same period. A $1,000 investment in XRP WOULD have ballooned to $12,700, while the same amount in the index would have yielded just $2,010.

The cryptocurrency's rise from $0.24 to $3.04 demonstrates the asymmetric growth potential of digital assets compared to traditional markets. This performance gap highlights the divergent risk-reward profiles of crypto versus equities, with XRP serving as a prime example of outsized returns in the altcoin space.

Market analysts note such comparisons must account for crypto's inherent volatility. While the S&P 500 represents steady economic growth, XRP's trajectory reflects cryptocurrency markets' capacity for exponential moves amid evolving regulatory and adoption landscapes.

FuturoMining Expands Cloud Mining Options for XRP Users

FuturoMining has introduced a contract-based model for cryptocurrency users seeking structured participation without traditional trading. The platform, which reportedly enables XRP holders to generate up to $7,700 in daily passive income, offers a stable alternative to volatile short-term trading strategies.

Operating on a "contract cloud mining" framework, FuturoMining eliminates the need for market monitoring or infrastructure management by providing daily settlements. The company emphasizes security and transparency, ensuring compliance with legal standards while utilizing clean energy for carbon-neutral operations.

Key features include an $18 registration bonus, multi-crypto settlements across nine digital assets, and a referral program with commission incentives. The platform guarantees 100% uptime and provides round-the-clock technical support.

REX Osprey XRP ETF Debuts with $37M Volume, Outperforming Futures Counterparts

The first U.S. spot XRP ETF, REX Osprey XRP ETF, launched on September 18 with a striking $37.7 million in daily trading volume—five times higher than its futures counterparts. Bloomberg ETF analyst Eric Balchunas termed the performance a 'good sign' for upcoming spot XRP ETFs, despite the product's expedited regulatory pathway under a different regime.

XRP's price, however, failed to mirror the ETF's strong debut, dipping 3% as it struggled to break the $3 resistance level. Technical indicators like the RSI suggest bullish sentiment remains, but on-chain data hints at potential sell pressure.

Institutional Accumulation of XRP Signals Potential Supply Shock

BlackRock and JPMorgan have been quietly amassing significant XRP positions over several years, according to a market analyst. This accumulation coincides with retail investors divesting their holdings, setting the stage for a potential supply shock.

The analyst projects XRP could reach $10,000, citing its potential integration into global financial systems and tokenized asset settlement networks. At $3.08 with a 2% daily gain, the token's price ceiling appears nonexistent when measured against its utility demand.

Institutional strategy appears deliberate—accumulating during periods of retail sell pressure while positioning XRP as "digital Gold in motion" for future financial infrastructure. The XRP Ledger's scalability design positions it as a likely conduit for global liquidity flows, particularly in tokenization and stablecoin transactions.

How High Will XRP Price Go?

Based on current technical indicators and fundamental developments, XRP shows strong potential for upward movement. The convergence of institutional adoption through ETFs, stablecoin integrations, and technical consolidation above key moving averages creates a bullish setup. While short-term resistance near $3.18 may cause temporary pauses, the institutional accumulation patterns and record ETF performances suggest potential targets towards $15 in the medium term, contingent on broader market conditions and continued adoption momentum.

| Timeframe | Target Price | Key Drivers |

|---|---|---|

| Short-term (1-3 months) | $3.50 - $4.00 | ETF inflows, technical breakout |

| Medium-term (6-12 months) | $8.00 - $15.00 | Institutional adoption, supply dynamics |

| Long-term (12+ months) | $15.00+ | Mainstream integration, market cycle |